Making Moments that Matter

Hello, We’re Interactions 🚀

We’re a team of CX innovators that transform customer support into effortless and craveable experiences. We do it for the world’s leading brands.

Our Secret Sauce Is Our People

Mission

Make every interaction effortless

Vision

Interactions creates amazing customer experiences by advancing AI technology that understands and engages on a human level

Our Story:

A Passion for People

Founded in 2004 and headquartered near the world’s greatest city, Boston, MA, we’re a remote-first company with a global workforce committed to delivering extraordinary customer experiences.

We enable leading brands to have millions of productive conversations with their busy customers.

Every day, we make people’s customer experiences effortless, no matter if they’re talking, tapping, typing or swiping with a brand.

Along the way, we create millions of happier, more loyal customers and save our clients millions of dollars annually.

Bringing values to life with a team-first culture

We believe in teamwork. We believe in rewarding hard work. 98% of employees are happy with their benefits.

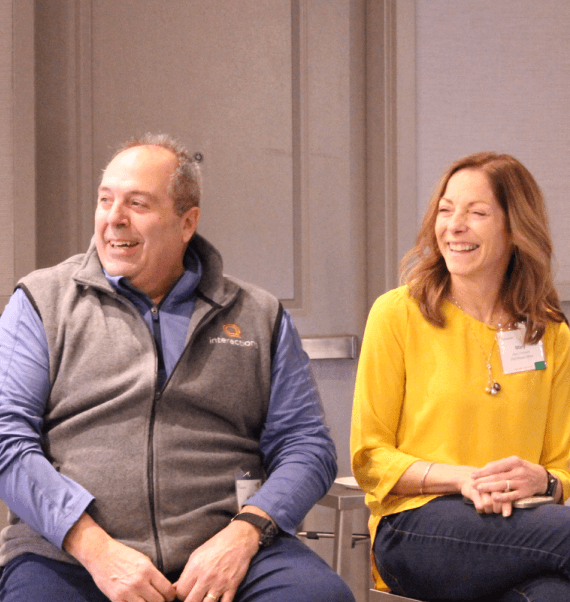

Meet

Our Leaders

Our leaders are passionate about many things – business success, team culture, and above all else, great customer engagements.

We give a damn.

Lots of damns.

- 2024

- 2023