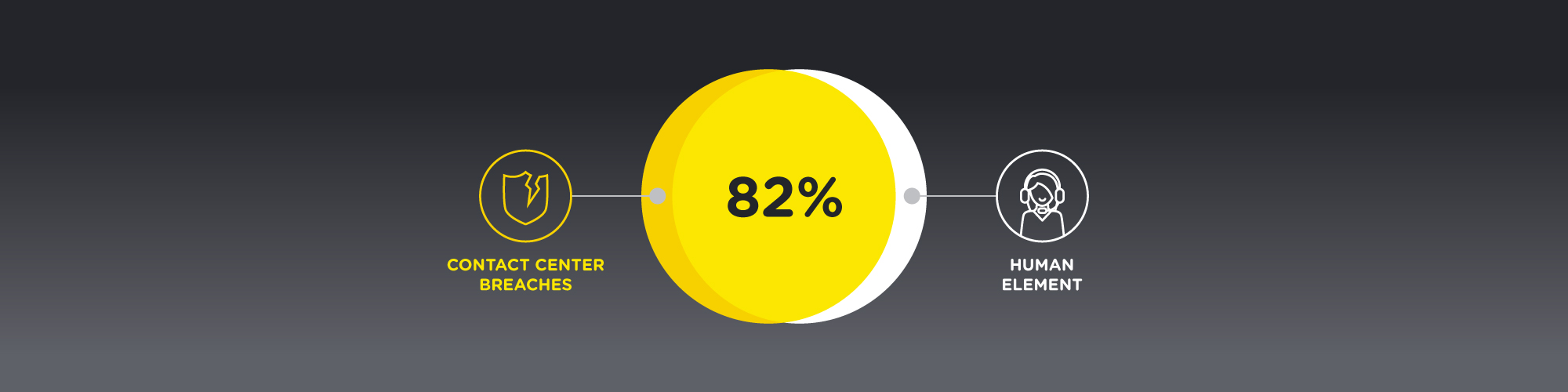

Humans remain the number one driver of the need for compliance and data breaches today, demonstrating that security is no longer just a technical challenge but a human one as well.

Plenty of statistical data supports this claim:

- 82% of breaches involved the human element. (Verizon)

- 44% of data breaches include PCI or PII. (IBM)

- Insider threat incidents have risen 44% over the last two years. (IBM)

- Per incident costs are up more than a third to $15.38 million. (IBM)

- On average, 5% of contact center agents intentionally participate in some form of insider fraud. (Fraud.net)

Work from Home Increases Risk Factors

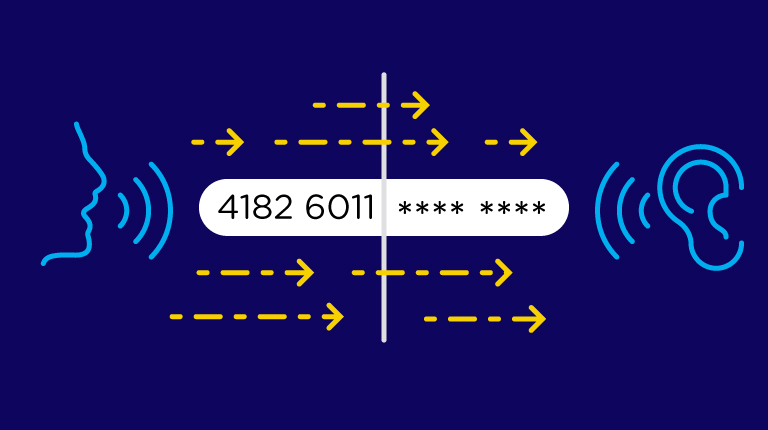

Work-from-home (WFH) agents present another element of risk. Just like their in-office counterparts, WFH agents gather PII, such as names, phone numbers, social security numbers, and other sensitive data.

Yet, more than half have not been provided with new guidelines on handling PII, even though 42% are required to do so — 72% read the credit card number aloud. That’s extremely serious, given that a typical data breach involving a remote worker costs $5 million.

The problem isn’t going away, either. Gartner Research projects that the customer experience WFH workforce will increase to 35% by 2023, presenting an even greater risk of customer data breaches.

Existing Redaction Solutions Are Inadequate

Despite the risks, many companies still rely on insecure contact center data redaction practices. These include dual-tone multi-frequency (DTMF) suppression, agent-triggered redaction, on-premise call transferring, and redirection of customers to a secure form.

Interactions Trustera Prevents Fraud and Ensures Compliance

There must be a better way — and there is — Interactions Trustera, the world’s first real-time, audio-sensitive redaction platform.

Interactions Trustera is an easy-to-use solution that does not require customers to enter card details into a phone keypad. It also enables conversations to comply entirely with PCI-DSS and PA-DSS requirements, regardless of where an agent works, in-office or from home.