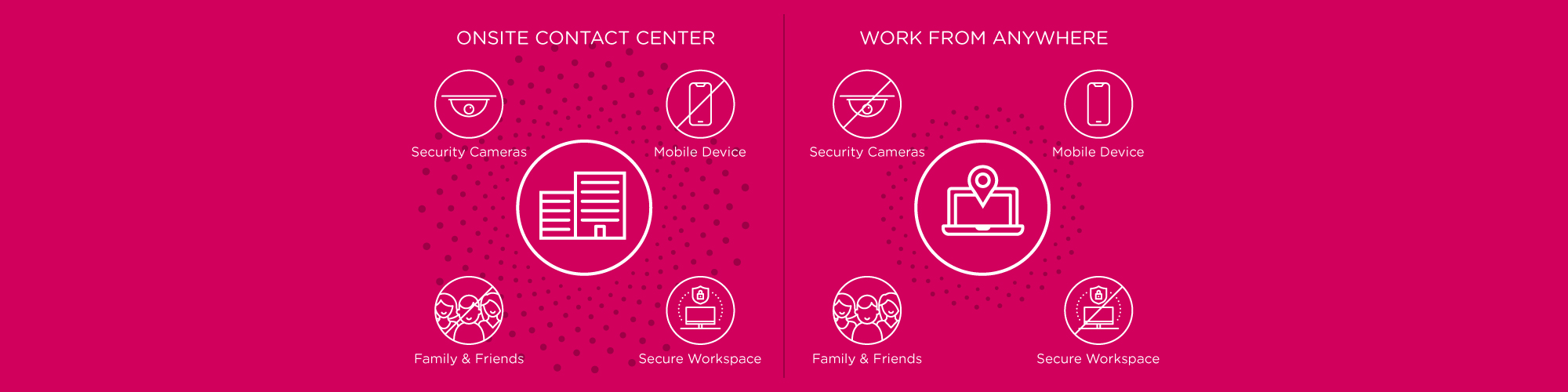

Protecting customer PCI data is always a risk for contact centers, regardless of whether agents work in-center or remotely. However, with more agents working offsite, contact center PCI compliance becomes much harder to enforce.

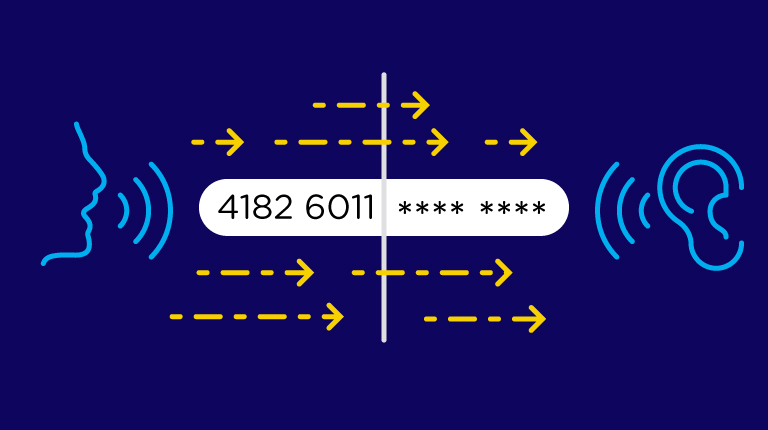

One of the biggest challenges lies in remote contact center agents taking credit card data over the phone. While agents must accept PCI telephone payments securely, remote work environments can be challenging to safeguard..

There’s no effective way to monitor agents to ensure adherence to clean desk policies, that the agent doesn’t retain PCI for illicit purposes, or guarantee another person isn’t within earshot of the conversation.

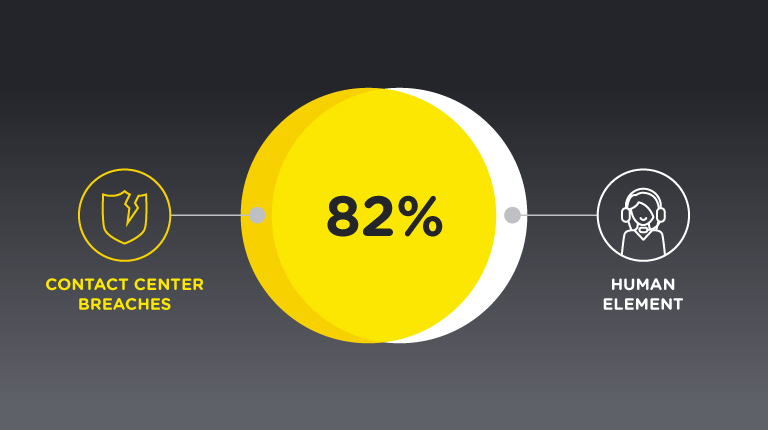

Meeting remote work PCI compliance requirements can be costly and time-consuming, but the alternative is worse. Non-compliant companies face fines, increased risk of data breaches, and damage to their reputation. To illustrate, a Ponemon Institute report says that insider threat incidents have risen 44% over the last two years, with the cost per incident increasing to an estimated $15 million.

With these challenges in mind, here are four ways to navigate contact center PCI compliance with remote work agents.

Establish Clear Policies and Procedures

Remote work agents need to understand the importance of PCI compliance and their role in maintaining it. Developing clear policies and procedures will help provide a framework for agents to follow.

Guidelines should cover topics such as PCI information processing, the use of secure communication channels, and adherence to clean desk policies. Regularly review and update these policies to ensure they remain current and effective.

Provide Comprehensive Training

Ensure that all agents receive comprehensive training on PCI compliance and know the risks of handling sensitive cardholder data. Training should be ongoing with regular refresher courses and updates on new regulations or threats.

Foster a Security-minded Culture

Foster a security culture in your organization by encouraging open communication and empowering agents to take responsibility for their actions.

Partner with a PCI Compliance Solutions Company

The best way to achieve PCI compliance is to partner with a company specializing in contact center compliance solutions.

Interactions, a leading PCI compliance solutions provider, can help your company assess its compliance risks and implement measures to protect sensitive customer data.

Don’t leave your contact center’s compliance to chance. Partner with Interactions today and ensure that your customers’ sensitive data is always secure. Contact us to learn more about our PCI compliance solutions.