Credit card security? It’s a big deal.

Especially for any contact center that accepts payments over the phone.

In order to protect sensitive customer data and maintain trust, these organizations must comply with the Payment Card Industry Data Security Standard (PCI-DSS), which includes strict standards for storing and handling credit card data.

Here’s the problem:

The risks associated with accepting credit card payments are numerous and can be devastating for businesses that fail to properly protect their customers’ sensitive information. Not only can a data breach lead to financial losses, but it can also damage a company’s reputation and result in a loss of customer trust.

According to a report from the Ponemon Institute, 44% of all data breaches involve the theft of Personal Identifiable Information (PII), and on average, a breach involving PII and remote working costs $4.9 million. So it’s crucial for businesses to take steps to prove their trustworthiness.

One of the most effective ways to mitigate these risks is to ensure compliance with the PCI-DSS standards. However, even with these standards in place, there is still a risk of human error.

Here’s what can be done about it:

To address this issue, redaction is the only solution. Redaction involves removing sensitive information in real-time to eliminate the possibility of human error. By adopting this practice, businesses can provide the highest level of data security and maintain the trust of their customers.

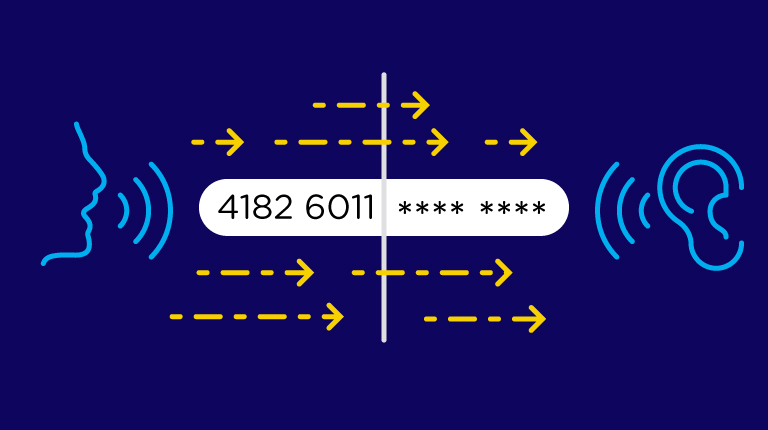

Trustera is the world’s first real-time, audio-sensitive redaction platform. Using AI, Trustera anticipates and masks sensitive information that is often shared during conversations between agents and customers. The result? Agents in the new work-from-anywhere model remain PCI compliant and customer experience remains high.

Learn more about Trustera in here.